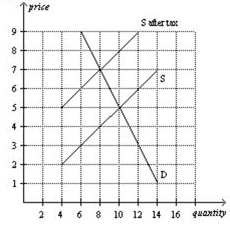

Using the graph shown, answer the following questions.

a. What was the equilibrium price in this market before the tax?

b. What is the amount of the tax?

c. How much of the tax will the buyers pay?

d. How much of the tax will the sellers pay?

e. How much will the buyer pay for the product after the tax is imposed?

f. How much will the seller receive after the tax is imposed?

g. As a result of the tax, what has happened to the level of market activity?

Definitions:

Sustainability Efforts

Initiatives and practices aimed at preserving environmental resources and ensuring the long-term viability of processes or operations.

CSR Activities

Corporate Social Responsibility activities are actions taken by businesses to improve society and contribute positively to the community and environment.

Future Generations

Individuals who will live in the succeeding periods, whose interests are considered in long-term planning and sustainability efforts.

Eco-Efficiency Measure

An assessment of the economic performance of a process or product in terms of its environmental impacts, aiming for sustainability by reducing resources used and waste produced.

Q28: If the price of oak lumber increases,

Q44: Refer to Figure 6-8. The price of

Q60: Which of the following is not true

Q221: A tax imposed on the buyers of

Q235: Refer to Table 7-11. If the market

Q262: A tax levied on the sellers of

Q326: Refer to Figure 7-27. If the government

Q332: A binding minimum wage creates unemployment.

Q487: Renters of rent-controlled apartments will likely benefit

Q554: Refer to Figure 6-15. For a price