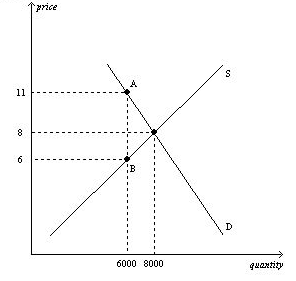

Using the graph shown, in which the vertical distance between points A and B represents the tax in the market, answer the following questions.

a. What was the equilibrium price and quantity in this market before the tax?

b. What is the amount of the tax?

c. How much of the tax will the buyers pay?

d. How much of the tax will the sellers pay?

e. How much will the buyer pay for the product after the tax is imposed?

f. How much will the seller receive after the tax is imposed?

g. As a result of the tax, what has happened to the level of market activity?

Definitions:

Outgroup Attribution

The tendency to attribute the behavior and outcomes of individuals who are not members of one's own group to their inherent characteristics, rather than to situational factors.

Consolidation

Consolidation refers to the process of making a position of power or achievement secure and stable, or in psychology, the process by which memories become stable in the brain.

Dissenting View

An opinion that differs from the consensus or majority viewpoint, highlighting the presence of diverse perspectives in discussions or debates.

Informational Influence

A form of social influence where an individual changes their behavior or beliefs based on information received from others.

Q63: Refer to Table 6-5. Suppose the government

Q119: Refer to Figure 6-6. Which of the

Q152: Refer to Scenario 6-1. If the government

Q236: The minimum wage is an example of

Q416: The burden that results from a tax

Q434: Suppose there is currently a tax of

Q446: Consumer surplus is a good measure of

Q447: FICA is an example of a payroll

Q634: Refer to Table 6-1. Suppose the government

Q637: When a price floor is binding, is