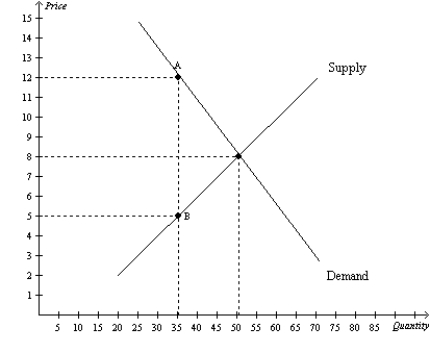

Figure 8-4

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-4.The price that buyers effectively pay after the tax is imposed is

Definitions:

Calls

A financial instrument giving the holder the right, but not the obligation, to buy an asset at a specified price within a specific period.

Period Cost

Costs that are not directly associated with the production of goods and are expensed in the period they are incurred, such as administrative and selling expenses.

Variable Cost

Charges that adjust according to the volume of goods produced or sold, specifically materials and labor costs.

Opportunity Cost

The foregone benefit that could have been achieved from options not chosen when selecting one among several alternatives.

Q61: Refer to Figure 8-5. The tax causes

Q73: Refer to Figure 8-7. Which of the

Q78: Other things equal, the deadweight loss of

Q113: Refer to Figure 7-26. At the equilibrium

Q132: Refer to Figure 8-9. The total surplus

Q142: If a tax shifts the supply curve

Q161: For any given quantity, the price on

Q231: Refer to Figure 8-9. The loss of

Q282: If the government allowed a free market

Q451: The willingness to pay is the maximum