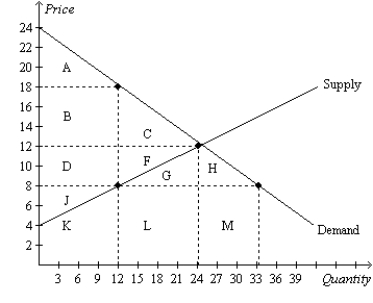

Figure 8-8

Suppose the government imposes a $10 per unit tax on a good.

-Refer to Figure 8-8.The tax causes consumer surplus to decrease by the area

Definitions:

Mobile Phones

Portable electronic devices used for communication purposes, including voice calls, text messaging, and internet access.

Consumer Prices

Prices paid by consumers for goods and services, which can be influenced by changes in supply and demand.

Profits

The financial gain achieved when the revenue from business activities exceeds the expenses, costs, and taxes needed to sustain the activity.

Productivity

The efficiency of production measured by the amount of output per unit of input.

Q5: The view held by Arthur Laffer and

Q36: When a tax is placed on the

Q70: Refer to Scenario 8-1. Assume Erin is

Q84: Refer to Figure 8-3. The amount of

Q150: John has been in the habit of

Q250: A tax on a good<br>A) raises the

Q362: Refer to Figure 8-25. Suppose the government

Q410: Let P represent price; let QS represent

Q426: Refer to Figure 8-25. Suppose the government

Q478: Refer to Figure 8-4. The amount of