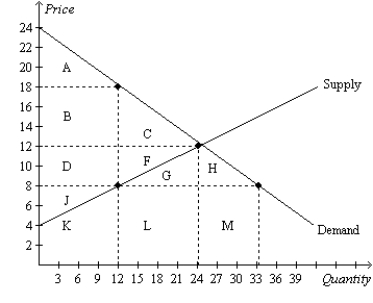

Figure 8-8

Suppose the government imposes a $10 per unit tax on a good.

-Refer to Figure 8-8.After the tax goes into effect,consumer surplus is the area

Definitions:

Acceptor

A person (drawee) who accepts and signs a draft to agree to pay the draft when it is presented.

Negotiable Instruments Liability

Legal accountability related to documents that promise payment to the bearer or named party, such as checks or promissory notes.

Primarily Liable

Refers to the main party responsible or legally obligated to fulfill a duty or pay a debt.

Secondarily Liable

Refers to a party's indirect responsibility to fulfill an obligation if the primary party fails to do so.

Q68: Producer surplus is the cost of production

Q128: The Laffer curve illustrates that<br>A) deadweight loss

Q153: Market power and externalities are examples of

Q193: Refer to Figure 9-8. In the country

Q349: Taxes affect market participants by increasing the

Q376: Refer to Figure 8-21. Suppose the market

Q444: Which of the following will cause a

Q488: Refer to Figure 8-29. As the size

Q501: If a market is allowed to adjust

Q512: The area below the price and above