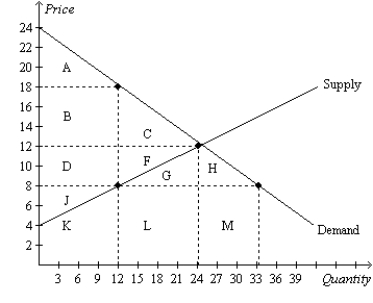

Figure 8-8

Suppose the government imposes a $10 per unit tax on a good.

-Refer to Figure 8-8.The deadweight loss of the tax is the area

Definitions:

Total Revenue Product

The overall income generated by a firm from selling its output, factoring in the quantity of output sold and the price per unit.

Marginal Physical Product

The additional output that results from using one more unit of a factor of production, keeping other factors constant.

Marginal Revenue Product

Marginal Revenue Product measures the increase in revenue realized from employing one additional unit of input, such as labor or capital, holding all other inputs constant.

Total Revenue Product

The total revenue product is the total revenue generated by a factor of production, such as labor or capital, based on its marginal product and the price of the goods or services produced.

Q26: Refer to Table 7-17. Both the demand

Q88: If the tax on a good is

Q143: Consider a good to which a per-unit

Q157: Refer to Figure 7-27. Sellers whose costs

Q212: PlayStations and PlayStation games are complementary goods.

Q232: Which of the following is not correct?<br>A)

Q300: Moving production from a high-cost producer to

Q333: Refer to Figure 8-13. Suppose the government

Q350: Taxes on labor encourage all of the

Q490: Refer to Figure 8-26. Suppose the government