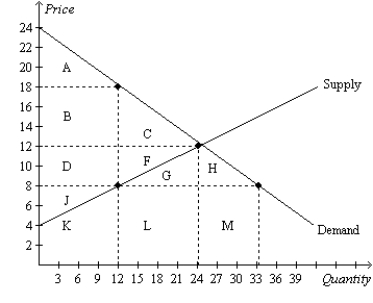

Figure 8-8

Suppose the government imposes a $10 per unit tax on a good.

-Refer to Figure 8-8.One effect of the tax is to

Definitions:

Productively

Refers to producing goods or services in a way that makes the best use of resources like time, materials, and labor.

Rule-of-law

The principle that all members of a society, including those in government, are equally subject to publicly disclosed legal codes and processes.

English-speaking Heritage

Refers to the cultural and historical influence of English-speaking countries and their traditions.

Per-capita GNI

The gross national income of a country divided by its population, reflecting the average income of its citizens.

Q116: Taxes are of interest to<br>A) microeconomists because

Q130: Consider a good to which a per-unit

Q219: Refer to Figure 8-11. The size of

Q236: Refer to Figure 8-29. If you were

Q242: When the nation of Worldova allows trade

Q276: Refer to Table 7-17. Both the demand

Q277: Refer to Figure 8-26. Suppose the government

Q379: Suppose a tax is imposed on baseball

Q458: Suppose you sell a kayak for $600,

Q526: If the United States legally allowed for