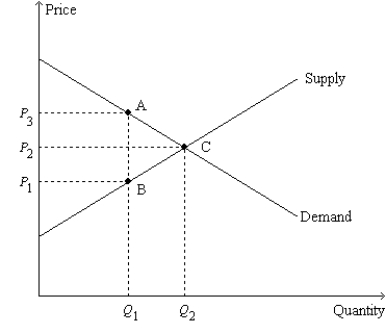

Figure 8-11

-Refer to Figure 8-11. Suppose Q1 = 4; Q2 = 7; P1 = $6; P2 = $8; and P3 = $10. Then the deadweight loss of the tax is

Definitions:

Higher Price

An increase in the cost of a good or service, often reflecting factors like demand and supply changes, production costs, or market conditions.

Supply And Demand Theory

A basic economic principle that describes how the quantity of goods provided by producers and the quantity desired by consumers affect the market price and allocation of resources.

Sales Tax

A tax imposed by a government on sales of goods and services, typically calculated as a percentage of the purchase price.

Burden

In an economic context, this refers to the impact of a tax or other financial obligation on the parties involved, often measured in terms of how it affects their wealth or consumption.

Q178: Refer to Scenario 8-3. Suppose that a

Q178: Refer to Figure 9-7. The equilibrium price

Q208: The principle of comparative advantage asserts that<br>A)

Q216: Many economists believe that restrictions against ticket

Q224: According to many economists, government restrictions on

Q241: Refer to Figure 7-34. Suppose the government

Q280: By comparing the world price of pecans

Q286: Refer to Figure 8-25. Suppose the government

Q361: When the government places a tax on

Q379: Suppose a tax is imposed on baseball