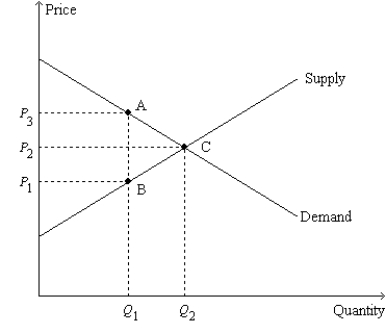

Figure 8-11

-Refer to Figure 8-11. Suppose Q1 = 4; Q2 = 7; P1 = $6; P2 = $8; and P3 = $10. Then, when the tax is imposed,

Definitions:

Income Change

A variation in the amount of earnings received by a household or individual, which could arise from sources such as wages, investments, or benefits.

Price Change

Refers to the variance in the cost of goods or services over time, which can be an increase or a decrease.

Market Quantity

The total amount of a specific good or service that is available for purchase in a market at a given time.

Buyers

People or organizations that acquire products or services within a marketplace.

Q15: Assume the price of gasoline is $2.00

Q21: Refer to Figure 8-10. Suppose the government

Q63: Refer to Figure 9-1. When trade in

Q260: Refer to Figure 7-21. When the price

Q284: The "invisible hand" is<br>A) used to describe

Q306: In the market for widgets, the supply

Q346: Refer to Figure 8-3. The price that

Q423: Hot dogs and hot dog buns are

Q466: Total surplus is always equal to the

Q477: Total surplus = Value to buyers -