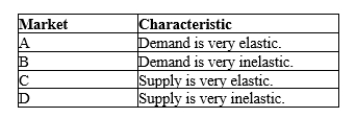

Table 8-1

-Refer to Table 8-1. Suppose the government is considering levying a tax in one or more of the markets described in the table. Which of the markets will maximize the deadweight loss(es) from the tax?

Definitions:

Form 1099-INT

A tax form used to report interest income earned from banks, savings accounts, or other financial institutions during the tax year.

Interest Income

Income earned from deposit accounts such as savings accounts, CDs, or from loans and bonds issued by the taxpayer.

Workers' Compensation

Insurance providing wage replacement and medical benefits to employees injured in the course of employment.

Taxable

Refers to income or transactions that are subject to tax by governmental entities according to certain rules and regulations.

Q6: Refer to Figure 8-7. As a result

Q63: Market power and externalities are examples of<br>A)

Q97: Refer to Figure 8-2. The loss of

Q99: Suppose a country abandons a no-trade policy

Q140: Refer to Figure 8-3. The per-unit burden

Q182: Refer to Figure 8-26. Suppose the government

Q326: When a country allows trade and becomes

Q346: Refer to Figure 8-3. The price that

Q388: Externalities are<br>A) side effects passed on to

Q426: When markets fail, public policy can<br>A) do