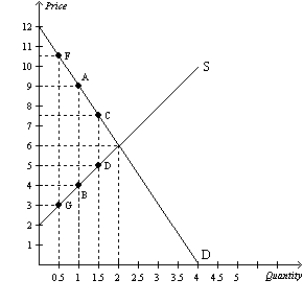

Figure 8-19

The vertical distance between points A and B represents the original tax.

-Refer to Figure 8-19.If the government changed the per-unit tax from $5.00 to $2.50,then the price paid by buyers would be $7.50,the price received by sellers would be $5,and the quantity sold in the market would be 1.5 units.Compared to the original tax rate,this lower tax rate would

Definitions:

Cash Dividends

These are payments made by a company out of its profits to its shareholders, usually in the form of cash.

Cash Flow

The sum of funds being moved into and out of a company, particularly in relation to its cash flow.

Financing Activities

All transactions (other than interest payments) involving borrowing from creditors or repaying creditors as well as transactions with the company’s owners.

Cash Flow

The total amount of money being transferred into and out of a business, measuring its financial health.

Q46: Refer to Figure 8-9. The per-unit burden

Q61: Refer to Figure 9-1. With trade, Guatemala

Q111: A tax levied on the sellers of

Q157: When a tax is imposed on a

Q199: When a country allows international trade and

Q200: At present, the maximum legal price for

Q243: Economists argue that restrictions against ticket scalping

Q247: Refer to Figure 8-6. Without a tax,

Q303: Refer to Figure 9-6. With trade and

Q458: Refer to Figure 9-4. With trade, Nicaragua<br>A)