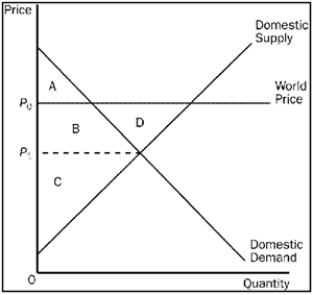

Figure 9-9

-Refer to Figure 9-9.Consumer surplus in this market before trade is

Definitions:

Black-Scholes Option Pricing Model

A mathematical model used to determine the theoretical price of European put and call options, incorporating factors like volatility and time to expiration.

Strike Price

The fixed price at which the holder of an option can buy (call) or sell (put) the underlying security or commodity.

Call

In finance, an option contract giving the owner the right, but not the obligation, to buy a specified amount of an underlying asset at a specified price within a specified time.

Put Option Contract

A financial contract giving the owner the right, but not the obligation, to sell a specified amount of an underlying security at a specified price within a specified time.

Q67: The United States has imposed taxes on

Q83: Refer to Figure 8-11. The deadweight loss

Q93: Refer to Figure 9-17. Without trade, consumer

Q135: Which of the following assertions is not

Q270: Economists use the government's tax revenue to

Q280: By comparing the world price of pecans

Q332: An externality is an example of<br>A) a

Q418: In the early 1980s, which of the

Q467: Refer to Figure 8-9. The loss of

Q495: Refer to Figure 8-25. Suppose the government