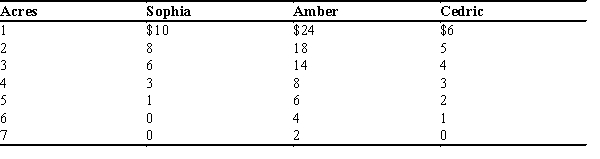

Table 11-1

Consider the town of Springfield with only three residents, Sophia, Amber, and Cedric. The three residents are trying to determine how large, in acres, they should build the public park. The table below shows each resident's willingness to pay for each acre of the park.

-Refer to Table 11-1. Suppose the cost to build the park is $9 per acre and that the residents have agreed to split the cost of building the park equally. If the residents vote to determine the size of park to build, basing their decision solely on their own willingness to pay (and trying to maximize their own surplus) , what is the largest park size for which the majority of residents would vote "yes?"

Definitions:

Bad Debt Expense

The portion of receivables that a company estimates it will not collect, considered as an expense in the income statement.

Estimated Uncollectible Accounts

An accounting provision for debts that are anticipated to be uncollectable from customers or clients.

Direct Write-off Method

An accounting approach where uncollectable accounts receivable are directly written off against income at the time they are deemed to be uncollectible.

Generally Accepted Accounting Principles

A set of rules, standards, and practices used by accountants in the U.S. to prepare, present, and report financial statements.

Q22: Refer to Figure 10-19. Note that the

Q45: Recall the four types of goods. Are

Q70: Refer to Scenario 13-14. Farmer Brown's production

Q85: Refer to Scenario 11-3. Which of these

Q245: Even economists who advocate small government agree

Q265: Economists think that the best way to

Q277: In markets, the invisible hand allocates resources

Q282: In a cost-benefit analysis, the value of

Q286: What particular characteristic do public goods and

Q478: The difference between a corrective tax and