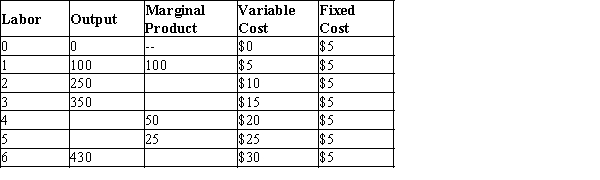

Table 13-19

-Refer to Table 13-19. What is the marginal product of the second worker?

Definitions:

Deferred Tax Asset

An asset on the balance sheet representing taxes paid or carried forward but not yet realized. This can arise due to timing differences between the recognition of income and expenses for financial reporting and tax purposes.

Taxable Income

The amount of income used to calculate how much tax an individual or a company owes to the government in a specific tax year.

Warranty Expenses

Costs associated with the obligation to repair or replace products that fail to meet specified standards.

Interperiod Tax Allocation

The process of distributing the tax effects of transactions over various accounting periods.

Q26: Refer to Table 13-2. What is the

Q33: Refer to Scenario 13-9. According to Ellie's

Q39: Economic profit is equal to total revenue

Q83: An example of an opportunity cost that

Q135: Refer to Table 13-19. What is the

Q331: Refer to Scenario 13-8. What are Wanda's

Q344: Refer to Scenario 13-11. An economist would

Q360: Refer to Table 13-18. What is the

Q384: Refer to Figure 13-3. The graph illustrates

Q395: For a firm, the relationship between the