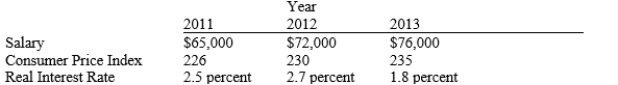

Table 24-11. Megan's salary for three consecutive years, along with other values, is presented in the table below.

-Refer to Table 24-11. Megan's 2011 salary in 2013 dollars is

Definitions:

Capital Gains

The profit that results from selling an asset for more than its purchase price, often related to investments or real estate.

Non-Eligible Dividends

are dividends that come from earnings that have not been taxed at the general corporate rate, often receiving less favorable tax treatment than eligible dividends.

Marginal Provincial Tax Rate

The rate at which your next dollar of taxable income would be taxed, specific to the province in the context of Canadian taxation.

Provincial Tax Rates

The percentage rate at which income, goods, services, and transactions are taxed by individual provinces or territories in Canada.

Q1: Between 1929 and 1933, NNP measured in

Q3: Which of the following countries had the

Q18: Refer to Table 24-5. If the base

Q105: Human capital is the<br>A) knowledge and skills

Q107: With respect to the consumer price index,

Q194: Which of the following statements best represents

Q264: Which of the following is an example

Q357: Expenditures by households on education are included

Q388: Which of the following statements is correct?<br>A)

Q508: From 2013 to 2014, the CPI for