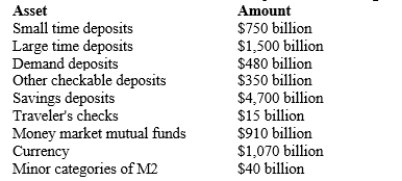

Table 29-1. The information in the table pertains to an imaginary economy.

-Refer to Table 29-1. What is the value of M1 in billions of dollars?

Definitions:

Spot Trade

An agreement to trade currencies based on the exchange rate today for settlement in two days.

Exchange Rate

The rate at which one currency can be exchanged for another, usually used in international trade and finance.

Counterparty

Second borrower in currency swap. Counterparty borrows funds in currency desired by principal.

Currency Swap

A Currency Swap is a financial derivative that involves the exchange of principal and interest payments in one currency for those in another, commonly used by companies to manage foreign exchange risk.

Q9: If the reserve ratio is 8 percent,

Q68: Most financial assets other than money function

Q141: In the last part of the 1800's<br>A)

Q153: In the United States, currency holdings per

Q156: Discuss why the Fed rarely changes the

Q212: Which of the following is correct?<br>A) A

Q217: If the Federal Reserve increases the interest

Q328: Refer to Table 29-3. The bank's reserve

Q422: Adults who are waiting to be recalled

Q473: What is bank insolvancy?