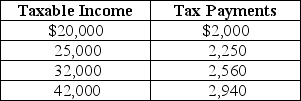

Table 18-5

Table 18-5 shows the amount of taxes paid on various levels of income.

-Refer to Table 18-5.The tax system is

Definitions:

Diminishing Marginal Utility

The principle that as a person consumes more of a product, the satisfaction (utility) gained from each additional unit decreases.

Consumer Behavior

The study of individuals, groups, or organizations and the processes they use to select, secure, use, and dispose of products, services, experiences, or ideas to satisfy needs and the impacts that these processes have on the consumer and society.

Substitution Effect

The change in the quantity demanded of a good that results from a change in price, making the good more or less expensive relative to other goods.

Consumer Behavior

The study of individuals, groups, or organizations and the processes they use to select, secure, use, and dispose of products, services, experiences, or ideas to satisfy needs.

Q30: Which of the following statements regarding equilibrium

Q46: When the actual inflation rate turns out

Q73: Let MP = marginal product,P = output

Q82: A firm's demand curve for labor slopes

Q102: Suppose the labor market is in equilibrium.Which

Q152: An example of an intermediate good would

Q197: Refer to Figure 17-1.Suppose the market price

Q238: Refer to Figure 18-1.Of the tax revenue

Q250: If we want to use a measure

Q265: Marsha Murphy complained,"Many jobs that are filled