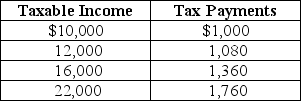

Table 18-8

Table 18-8 shows the amount of taxes paid on various levels of income.

-Refer to Table 18-8.The tax system is

Definitions:

Perpetual Inventory

A system of accounting for inventory that records the sale or purchase of inventory immediately through the use of computerized point-of-sale systems and enterprise asset management software.

Non-Cancellable Fixed Purchase Contract

A legally binding agreement to buy a specific quantity of goods or services at predetermined prices, where the contract cannot be cancelled without a breach.

Accrued Loss

A loss that has occurred but has not yet been recorded in the accounts through the normal accounting process, often recognized through adjusting entries.

Major Categories

General classifications used in various contexts, such as financial accounting, to organize items or concepts into distinct groups based on similar characteristics.

Q4: Under what circumstances will the law of

Q89: Disposable personal income equals personal income<br>A)minus personal

Q136: What happens to the equilibrium wage and

Q143: The labor market in Major League Baseball

Q162: Refer to Table 19-11.Nominal GDP for Tyrovia

Q177: If the marginal tax rate is equal

Q180: The problem with inflation is that as

Q189: The price of admission to Walt Disney

Q244: Which of the following is a true

Q287: You borrow $10,000 from a bank for