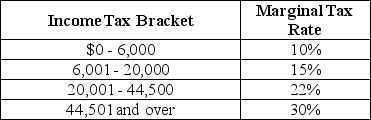

Table 18-9

Table 18-9 shows the income tax brackets and tax rates for single taxpayers in Monrovia.

-Refer to Table 18-9.Sylvia is a single taxpayer with an income of $70,000.What is her marginal tax rate and what is her average tax rate?

Definitions:

Personal Trust

An interest in an asset held by a trustee for the benefit of another person.

Efficient Frontier

A concept in portfolio theory representing the set of optimal portfolios offering the maximum expected return for a given level of risk or the minimum risk for a certain level of expected return.

Degree-Of-Risk Tolerance

The level of variability in investment returns that an investor is willing to withstand in their investment portfolio.

Risk Aversion

The preference to avoid uncertainty in investment decisions, showing a tendency to prefer safer investments over riskier ones.

Q12: If the number of employees who quit,are

Q58: In a study conducted by Marianne Bertrand

Q59: Refer to Table 20-16.Looking at the table

Q65: According to the marginal productivity theory of

Q151: Refer to Table 19-21.Consider the following data

Q158: In 2014,which component of GDP had a

Q194: An increase in a perfectly competitive firm's

Q195: The size of the underground economy would

Q246: If your nominal wage rises faster than

Q253: From an economic perspective,price discrimination is desirable