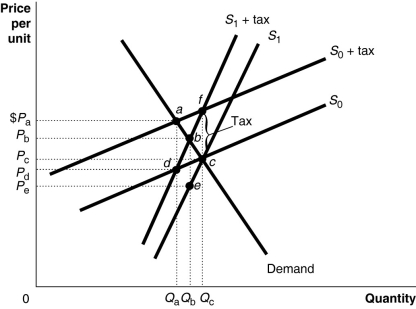

Figure 18-2 shows a demand curve and two sets of supply curves,one set more elastic than the other.

Figure 18-2 shows a demand curve and two sets of supply curves,one set more elastic than the other.

-Refer to Figure 18-2.If the government imposes an excise tax of $1.00 on every unit sold,what is the size of the deadweight loss,if there is any?

Definitions:

Variable Costing

A pricing approach that incorporates solely the variable costs of production—such as direct materials, direct labor, and variable manufacturing overhead—into the cost per unit of products.

Variable Production Costs

Costs that vary directly with the level of production, such as raw materials and direct labor.

Product Costs

All costs that are involved in acquiring or making a product. In the case of manufactured goods, these costs consist of direct materials, direct labor, and manufacturing overhead. Also see Inventoriable costs.

Absorption Costing

A costing method that includes all manufacturing costs—direct materials, direct labor, and both variable and fixed manufacturing overhead—in unit product costs.

Q57: Which of the following is the largest

Q65: An example of a payroll tax in

Q82: What does a Lorenz curve illustrate?<br>A)a comparison

Q187: Macroeconomics,as opposed to microeconomics,includes the study of

Q213: What is the difference between the poverty

Q213: Which of the following is included in

Q214: Between 1980 and 2014,income inequality in the

Q238: Suppose you have worked at a local

Q245: If inflation is positive and is perfectly

Q253: The horizontal-equity principle of taxation is not