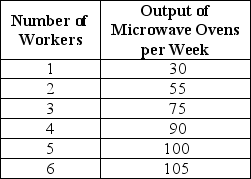

Table 17-3

Hotspur Incorporated, a manufacturer of microwave ovens, is a price taker in its input and output markets. The firm hires labor at a constant wage rate of $800 per week and sells microwave ovens at a constant price of $80. Table 17-3 shows the relationship between the quantity of labor it hires and the quantity of microwave ovens it produces. Assume that labor is the only variable input.

-Refer to Table 17-3.What is the amount of revenue added as a result of hiring the fourth worker?

Definitions:

Taxable Income

The portion of an individual or company's income used to determine how much tax is owed to the government in a given tax year.

Federal Income Tax

A tax levied by the United States federal government on the annual earnings of individuals, corporations, trusts, and other legal entities. Tax rates vary based on income levels and types of filers.

Progressive Tax

A tax system where the tax rate increases as the taxable amount increases, typically aimed at ensuring higher earners pay a larger percentage of their income in taxes.

Regressive Tax

A tax imposed in such a way that the tax rate decreases as the amount subject to taxation increases, burdening lower-income individuals relatively more than higher-income ones.

Q19: In the circular flow diagram,the value of

Q36: The demand for labor is a derived

Q50: According to projections for 2016 by the

Q113: Income inequality in the United States has

Q139: What is regulatory capture?<br>A)It is a situation

Q155: Which of the following best explains why

Q190: Why do we not count the value

Q209: Refer to Figure 18-1.Of the tax revenue

Q214: The Walt Disney Company uses cost-plus pricing

Q260: Let MP = marginal product,P = output