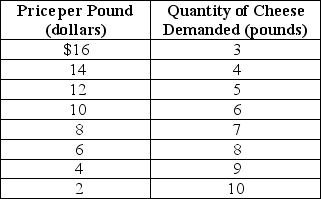

Table 6-3

-Refer to Table 6-3.Over what range of prices is the demand inelastic?

Definitions:

Individual Income Tax

A tax levied on the income of individuals, which varies according to the income levels and other factors.

Proportional Tax

A tax system where the tax rate is fixed and applied uniformly to all taxpayers, regardless of their income level.

Marginal Tax Rate

The percentage of tax applied to your income for each tax bracket in which you qualify, essentially the rate on the last dollar of income earned.

Average Tax Rate

The ratio of the total amount of taxes paid to the total tax base (taxable income or spending), expressed as a percentage.

Q19: Consider a situation in which a utility

Q44: Refer to Figure 7-2.The efficient equilibrium price

Q59: Overuse of a common resource may be

Q110: Each point on a _ curve shows

Q112: Insurance companies use deductibles and coinsurance to

Q169: Refer to Figure 7-2.At the efficient equilibrium<br>A)economic

Q236: Replacing employment-based health care with a government-run

Q249: According to a study of the price

Q272: The present value of $1,500 received 8

Q299: Juanita goes to the Hardware Emporium to