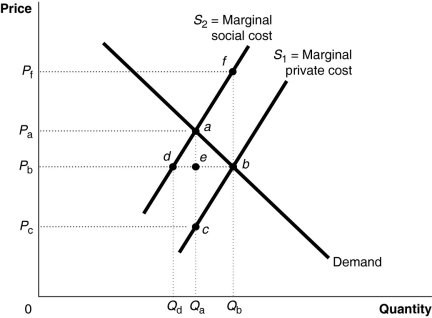

Figure 5-2 shows a market with a negative externality.

Figure 5-2 shows a market with a negative externality.

-Refer to Figure 5-2.The size of marginal external costs can be determined by

Definitions:

Market Interest Rates

The prevailing rate of interest available in the marketplace for securities, loans, and deposits, determined by supply and demand dynamics.

Par Value

The face value of a bond or the stock value stated in the corporate charter, which is the nominal value of a security.

Semi-Annual Interest

Interest that is calculated and paid twice a year, commonly found in bonds and certain types of loans.

Coupon Rate

Interest yielded on a bond each year, displayed as a percentage of its face value.

Q8: When the price of tortilla chips rose

Q22: For many small firms,providing health insurance for

Q59: Refer to Figure 7-5.The efficient quantity of

Q87: When there is a negative externality,the marginal

Q177: For the Coase theorem to work there

Q213: Refer to Figure 5-13.The market equilibrium quantity

Q217: According to a study of the U.S.demand

Q225: If tolls on a toll road can

Q241: The price elasticity of supply for umbrellas

Q279: Refer to Figure 4-5.The figure above represents