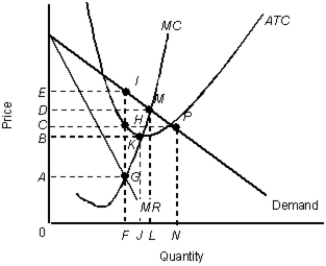

The figure given below shows the revenue and cost curves of a monopolistically competitive firm.Figure 12.4

MR: Marginal revenue curve

MR: Marginal revenue curve

ATC: Average total cost curve

MC: Marginal cost curve

-Which of the following theories applies to strategic behavior?

Definitions:

CAPM Beta

CAPM Beta is a measure used in the Capital Asset Pricing Model to determine the volatility or systemic risk of an asset in relation to the market as a whole.

Expected Return

Expected return is the predicted amount of profit or loss an investment is anticipated to generate over a specific period.

Coefficient

A coefficient is a numerical or constant quantity placed before and multiplying the variable in an algebraic expression, often representing a measure of some property or effect.

Variation

The degree to which data points in a set differ from the mean value of the set, indicating the distribution and dispersion of the set.

Q3: The recession beginning in 2007 led many

Q12: The figure below shows the supply curve

Q20: The figure given below shows the cost

Q29: A price discriminating monopolist charges a very

Q40: Suppose a mechanic uses $150, 000 of

Q48: Proponents of comparable worth justifies it on

Q73: Economic profits is the difference of total

Q80: A country on a gold standard was

Q81: When people prefer to obtain medical, or

Q89: The figure below shows the market equilibrium