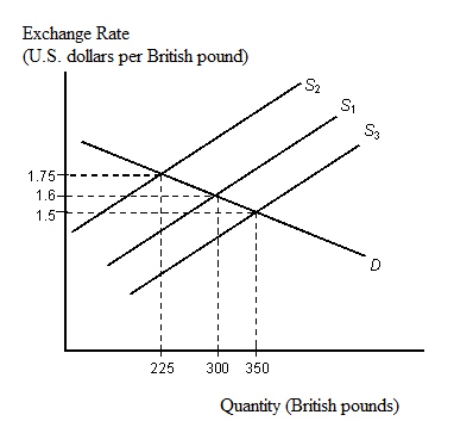

The figure given below depicts the foreign exchange market for British pounds traded for U.S.dollars. Figure 22.2  Refer to Figure 22.2.Suppose the British central bank is committed to maintaining an exchange rate of £1 = $1.50, but there is a permanent shift in supply from S1 to S3.According to the Bretton Woods agreement:

Refer to Figure 22.2.Suppose the British central bank is committed to maintaining an exchange rate of £1 = $1.50, but there is a permanent shift in supply from S1 to S3.According to the Bretton Woods agreement:

Definitions:

Investing Activities

Financial actions related to acquiring or disposing of non-current assets, part of a company's cash flow statement.

Bonds Payable

A long-term liability account that represents the amount owed by an entity to bondholders, to be repaid at a future date.

Accumulated Depreciation

The total amount of depreciation expense that has been recorded for an asset since it was put into use, reflecting its decrease in value over time.

Net Income

The remaining profit of a corporation once every expense, tax, and additional cost is deducted from the overall revenue.

Q3: Economic profit includes all opportunity costs.

Q9: Suppose the production of helicopters is an

Q13: The figure given below shows the demand

Q17: The data in the table below assumes

Q29: The figure given below shows cost curves

Q63: The table given below shows the total

Q86: If long-run costs are plotted on the

Q94: If the euro per dollar exchange rate

Q100: Deviations from purchasing power parity will be

Q125: An increase in the demand for rubles