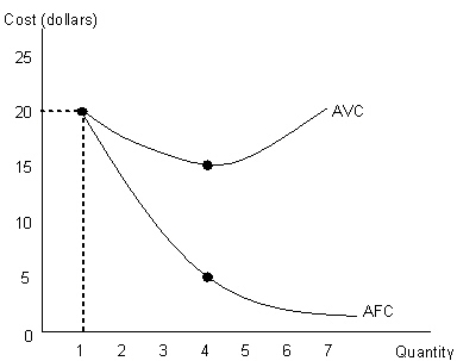

The figure given below shows the average fixed cost (AFC) and the average variable cost (AVC) curves of a competive firm. Figure 21.1  Refer to Figure 21.1.Compute the total cost of producing 4 units of the output.

Refer to Figure 21.1.Compute the total cost of producing 4 units of the output.

Definitions:

Deferred Tax Liability

A tax obligation that a company will have to pay in the future, arising out of current transactions that are recognized in the financial statements before they are taxable.

Tax Rate Change

An adjustment in the percentage at which an individual or corporation is taxed, affecting the computation of tax liabilities and net income.

Temporary Difference

A difference between the book value and tax value of an asset or liability that will result in taxable or deductible amounts in future years.

Accrued Product Warranty

Liabilities recognized for future costs related to warranty claims on products sold that have not yet been serviced.

Q3: Under the _ arrangement, the exchange rate

Q8: A firm gets less efficient as it

Q22: If a bushel of corn sells for

Q25: In the long run, total cost is

Q70: Assume that a Chrysler automobile sells for

Q84: Identify the characteristics of a monopoly firm.<br>A)Barred

Q86: One of the primary objectives of the

Q104: A country has a comparative advantage when

Q108: By discriminating between the consumers, the monopolist

Q119: The figure given below depicts the foreign