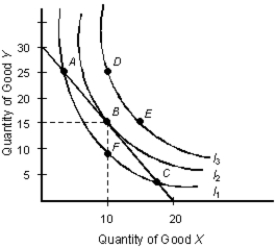

The below figure shows the various combinations of the goods X and Y that yield different levels of utility.Figure 7.3

-The shorter the period of time being considered, the less rapidly will diminishing marginal utility set in.

Definitions:

Binomial Model

An option-valuation model predicated on the assumption that stock prices can move to only two values over any short time period.

Exercise Price

The specified price at which the option holder can buy (in the case of a call option) or sell (in the case of a put option) the underlying asset.

Binomial Model

A mathematical model for pricing options that uses a discrete-time framework to trace the evolution of option prices over time.

Risk Free Interest Rate

The theoretical rate of return on an investment with zero risk, typically represented by the yield on government bonds.

Q13: The dollar return on a foreign investment

Q27: The less responsive consumers are to a

Q36: If a consumer is buying only goods

Q50: Purchasing power parity holds when the exchange

Q52: The most successful free trade agreements achieve

Q61: The data in the table below assumes

Q73: The original comparative advantage model that used

Q76: The Bretton Woods system required countries to

Q86: When barriers to trade are imposed, we

Q101: Income inequality is indicated by a Lorenz