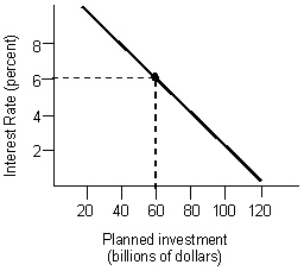

Scenario 13.1 Assume the following conditions hold. Now the Federal Reserve engages in an open market operation by purchasing $1 billion worth of government bonds from private bond dealers, who then deposit the $1 billion in the banks.This acts to lower the equilibrium interest rate by 2 percent.

Now the Federal Reserve engages in an open market operation by purchasing $1 billion worth of government bonds from private bond dealers, who then deposit the $1 billion in the banks.This acts to lower the equilibrium interest rate by 2 percent.  Refer to Scenario 13.1.What is the change in required reserves following the open market operation by the Fed?

Refer to Scenario 13.1.What is the change in required reserves following the open market operation by the Fed?

Definitions:

Extracellular

Located or occurring outside the cells of an organism.

Nasogastric Tube

A tube that is inserted through the nose into the stomach for feeding or medication administration.

Arterial Blood Gas

A test measuring the amounts of oxygen and carbon dioxide in the blood from an artery, used to assess lung function and blood gas exchange.

Respiratory Rate

The number of breaths a person takes per minute, a critical vital sign indicating respiratory health or distress.

Q23: Which of the following is true of

Q40: To fix the foreign currency price of

Q51: An automobile manufacturer uses land, labor, capital,

Q53: All of the following are reasons for

Q70: If the government is successful in internalizing

Q75: Suppose workers expect the inflation rate to

Q84: Other things equal, the higher the fiscal

Q105: A depository institution's profit is derived from

Q121: The rate of interest that the Federal

Q139: As the velocity of money rises, the