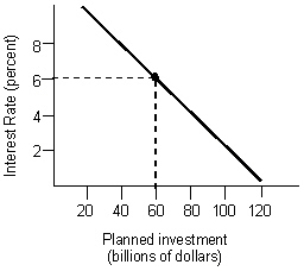

Scenario 13.2 Assume the following conditions hold. Now the Federal Reserve engages in an open market operation by purchasing $1 billion worth of government bonds from private bond dealers, who then deposit the $1 billion in the banks.This acts to lower the equilibrium interest rate by 2 percent.

Now the Federal Reserve engages in an open market operation by purchasing $1 billion worth of government bonds from private bond dealers, who then deposit the $1 billion in the banks.This acts to lower the equilibrium interest rate by 2 percent.  Refer to Scenario 13.1.What is the ultimate change in the money supply following the open market operation by the Fed?

Refer to Scenario 13.1.What is the ultimate change in the money supply following the open market operation by the Fed?

Definitions:

Q15: In which market structure model(s)is product differentiation

Q20: Traditional Keynesian economists believed that:<br>A)the aggregate supply

Q41: Which of the following is an intermediate

Q43: When regulators require that a natural monopoly

Q54: If a market becomes deregulated and is

Q67: The figure given below represents equilibrium in

Q73: According to the regulation Q, the maximum

Q97: A perfectly competitive firm hires more resources

Q102: Since only a few firms dominate the

Q111: The figure given below shows the demand