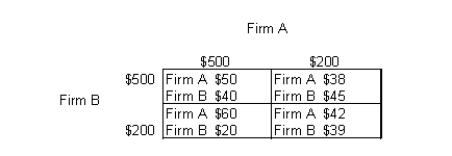

The table below shows the payoff (profit) matrix of Firm A and Firm B indicating the profit outcome that corresponds to each firm's pricing strategy (where $500 and $200 are the pricing strategies of two firms).Table 12.2

-Consumer loyalty tends to be very low in markets such as cola drinks and tobacco products.

Definitions:

Volatility

The statistical measure of the dispersion of returns for a given security or market index, often associated with the degree of risk involved.

Risk Premium

The additional return an investor demands for taking on additional risk above the risk-free rate.

Expected Rate

The expected rate refers to the forecasted return on an investment or the predicted growth rate of an asset over a specific period.

Standard Deviation

A statistical measure that quantifies the dispersion or variability of a set of data points or investment returns around their mean.

Q14: Suppose the real interest rate in the

Q18: In which of the following situations will

Q29: The free rider problem arises when a

Q33: The following figure shows equilibrium at the

Q39: A firm will shut down permanently if

Q41: Which of the following is not a

Q57: The table given below states the value

Q68: The table given below shows the real

Q68: Which of the following theories applies to

Q86: If a firm is a price taker,