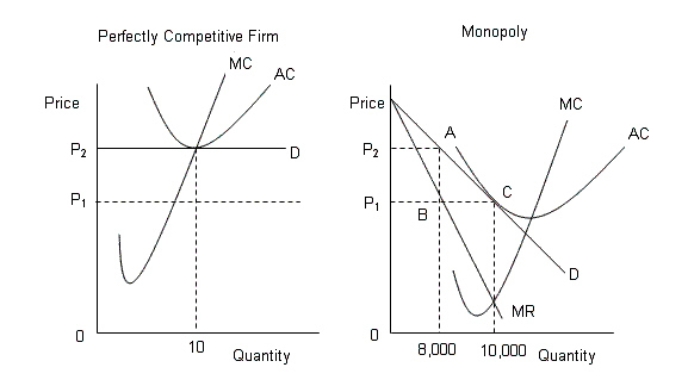

The following figures show the demand and cost curves of a perfectly competitive and a monopoly firm respectively. Figure 10.7  D: Average Revenue

D: Average Revenue

AC: Average cost

MC: Marginal cost

MR: Marginal cost

Refer to Figure 10.7.If the perfectly competitive industry and the monopoly produces the same quantity, then:

Definitions:

Leverage Ratio

A financial ratio indicating the level of debt used by a business to finance its assets and operations.

Interest Burden

The impact of interest expenses on a company's earnings, often expressed as a ratio or percentage of earnings before interest and taxes.

Return-On-Sales Ratio

A profitability metric that calculates the efficiency of a company in converting sales into profits, indicating how much of each dollar of sales is translated into profit.

ROE

Return on Equity, a measure of financial performance calculated by dividing net income by shareholders' equity, indicating how effectively management is using a company’s assets to create profits.

Q13: If it is assumed that there are

Q32: Consumption, saving, and wealth all represent stock

Q38: Which of the following statements is true

Q42: If the reserve requirement is 33.3 percent,

Q48: One of the popular myths about monopoly

Q75: As a perfectly competitive firm produces at

Q81: The figures given below represent the revenue

Q83: The figure given below shows the revenue

Q90: The higher the level of inflation, the

Q132: The table given below reports the value