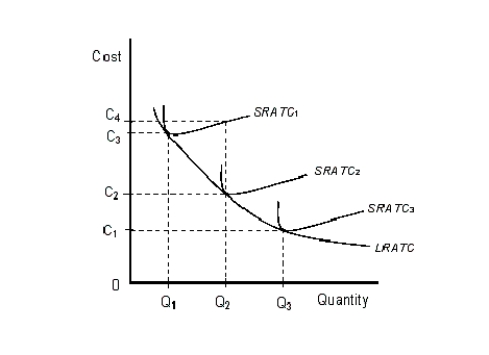

The figure given below shows three Short Run Average Total Cost (SRATC) curves and the Long Run Average Total Cost (LRATC) curve of a firm.Figure 8.3

-If a firm has constant returns to scale, then doubling all of its inputs will just double its output.

Definitions:

Incentives

Rewards or penalties intended to motivate specific behaviors or actions among individuals or entities.

Yield Curve Spread

The difference in yields between two different debt instruments, often used to gauge economic expectations.

T-Bond Yield

The annual return investors earn on U.S. Treasury bonds, which is a benchmark for long-term interest rates.

Federal Funds Rate

The interest rate at which banks lend reserve balances to other banks overnight, determined by the Federal Reserve.

Q10: If a large number of laborers shift

Q26: Consider GDP calculated according to the expenditures

Q62: During periods of inflation:<br>A)everyone's real income rises.<br>B)those

Q67: If a firm experiences constant returns to

Q71: Goodspeed Automobiles manufactures 100 disc brake cylinders.At

Q89: A decrease in the price level will

Q89: The four main components of the current

Q108: Which of the following would tend to

Q110: Scenario 8.2 Consider a publicly held firm

Q116: The only decision that a perfectly competitive