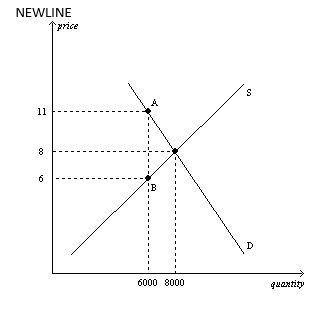

Using the graph shown, in which the vertical distance between points A and B represents the tax in the market, answer the following questions.

a. What was the equilibrium price and quantity in this market before the tax?

b. What is the amount of the tax?

c. How much of the tax will the buyers pay?

d. How much of the tax will the sellers pay?

e. How much will the buyer pay for the product after the tax is imposed?

f. How much will the seller receive after the tax is imposed?

g. As a result of the tax, what has happened to the level of market activity?

Definitions:

Material Misrepresentation

False or misleading statements that significantly affect another party's decision in a transaction.

Reasonable Person

A hypothetical individual in the legal system who exercises average care, skill, and judgment in conduct and is used as a standard to assess behavior.

Duress By Physical Force

The use of physical force or threats to compel someone to act against their will or to consent to an agreement.

Duress By Improper Threat

A situation where an individual is forced or coerced into a contract or legal agreement under threats that are unlawful or unethical.

Q4: Refer to Figure 6-4. A government-imposed price

Q9: Refer to Figure 6-18. The effective price

Q39: A tax of $1 on buyers always

Q55: When a tax is imposed on the

Q90: Taxes levied on sellers and taxes levied

Q99: When a tax is levied on sellers

Q173: Who bears the majority of a tax

Q222: Consumer surplus can be measured as the

Q464: The Earned Income Tax Credit is an

Q552: Which of the following statements is correct