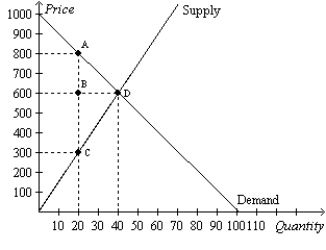

Figure 8-9

The vertical distance between points A and C represents a tax in the market.

-Refer to Figure 8-9.The producer surplus without the tax is

Definitions:

Capital Asset Pricing Model

A model that describes the relationship between systematic risk and expected return for assets, particularly stocks; it is used to determine a theoretically appropriate required rate of return of an asset.

Specific Risk

Risk associated with individual investments or a small group of assets, distinct from market risk.

Two-factor Model

A Two-factor Model in finance is an asset pricing model that uses two variables to calculate the value of an asset or the expected return.

Commodity Prices

The market prices for raw materials or primary agricultural products.

Q41: For any country, if the world price

Q72: Refer to Figure 7-34. Suppose the government

Q177: Refer to Scenario 7-2. Suppose a reduction

Q212: When demand increases so that market price

Q225: Efficiency is related to the size of

Q247: Refer to Figure 7-34. Suppose there is

Q285: Inefficiency exists in an economy when a

Q332: Refer to Figure 8-14. Which of the

Q385: Refer to Figure 8-11. The size of

Q418: Suppose Iceland goes from being an isolated