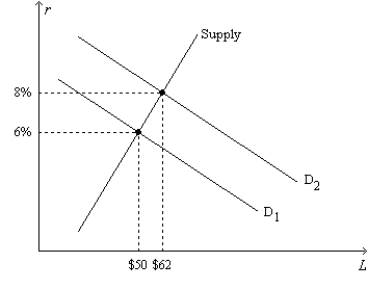

Figure 26-4. On the horizontal axis of the graph, L represents the quantity of loanable funds in billions of dollars.

-Refer to Figure 26-4. Which of the following events could explain a shift of the demand-for-loanable-funds curve from D1 to D2?

Definitions:

National Exchange

A formal marketplace where securities, commodities, derivatives, and other financial instruments are traded.

CBOE

Chicago Board Options Exchange, the largest options exchange in the world, known for trading options and other securities.

Listed Call Option

An option that gives the holder the right, but not the obligation, to buy a specified amount of an underlying security at a specified price within a specified time period, traded on a formal exchange.

Exercise Price

The cost at which the possessor of an option is able to purchase (in the case of a call option) or dispose of (in the case of a put option) the underlying asset.

Q44: Suppose a country has a larger increase

Q110: The catch-up effect refers to the idea

Q132: At which interest rate is the present

Q303: A decrease in the budget deficit<br>A) makes

Q334: Missy recently rearranged her portfolio so that

Q363: Greg's Tasty Ice Cream is considering building

Q379: A University of Iowa basketball standout is

Q499: How does the phenomenon of diminishing returns

Q516: A national chain of grocery stores wants

Q526: The interest rate will and the quantity