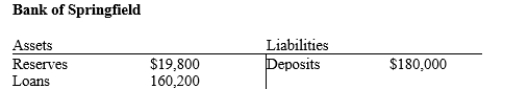

Table 29-7.

-Refer to Table 29-7. Assume the Fed's reserve requirement is 10 percent and that the Bank of Springfield makes new loans so as to make its new reserve ratio 10 percent. From then on, no bank holds any excess reserves. Assume also that people hold only deposits and no currency. Then by what amount does the economy's money supply increase?

Definitions:

Monthly Payments

Regular payments made over a period, often in the context of loans or leases where the total amount owed is divided into equal installments over time.

Mortgage

A legal agreement by which a bank or other creditor lends money at interest in exchange for taking the title of the debtor's property, with the condition that the conveyance of title becomes void upon the payment of the debt.

Investment Earnings

The return or income generated from various forms of investments, such as stocks, bonds, or real estate.

Q23: Over the past several decades in the

Q78: Members of the Board of Governors of

Q88: Bank regulators impose capital requirements in order

Q211: In an economy that relies upon barter,<br>A)

Q249: What is the change in the money

Q280: When the Federal Reserve conducts open-market operations

Q411: Causes of the changing role of women

Q463: Not all unemployment ends with the job

Q463: If the reserve ratio is 12.5 percent,

Q465: The Board of Governors<br>A) is chaired by