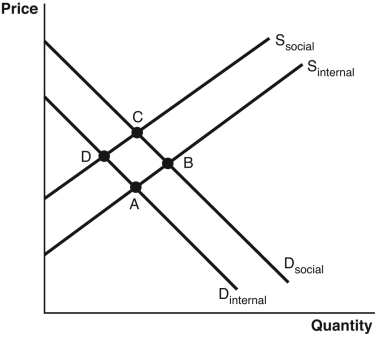

Consider the accompanying figure to answer the following questions.

-A positive externality exists and the government does not intervene.Which point best identifies the market equilibrium?

Definitions:

Tax Rate

The tax rate is the percentage at which an individual or corporation is taxed by the government on income, transactions, or property.

Implicit Marginal Tax Rate

Represents the rate at which an increase in income results in an increase in taxes plus the loss of government benefits, even if there's no explicit change in the tax bracket.

Government Benefits

Refers to forms of financial assistance or support provided by the government to individuals, families, or organizations, including subsidies, welfare, and social security.

Tax Rate

The percentage at which an individual or corporation is taxed.

Q10: The minimum wage law is an example

Q13: What type of good is often provided

Q32: When resources are used to secure monopoly

Q34: Which of the following is the best

Q41: If the government implements a cap-and-trade system

Q51: A firm's willingness to supply its product

Q78: Firms will always stay in the market

Q79: Ralph owns a small pizza restaurant, where

Q115: Which party is responsible for paying this

Q124: What is the surplus when the price