Use the following information to answer the next fifteen questions.

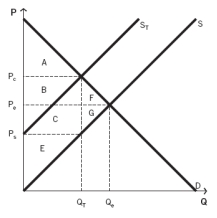

The following graph depicts a market where a tax has been imposed. Pₑ was the equilibrium price before the tax was imposed, and Qₑ was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-When a tax is imposed on some good,what tends to happen to consumer prices and producer prices?

Definitions:

Secondary Reinforcers

Stimuli that acquire their reinforcing power through their association with primary reinforcers.

Primary Reinforcers

Stimuli that satisfy basic survival needs and are innately reinforcing, such as food, water, and warmth.

Distinction

A discrepancy or divergence among alike objects or individuals.

Thorndike's Law

The principle that behaviors followed by favorable consequences become more likely, and behaviors followed by unfavorable consequences become less likely, known as the law of effect.

Q3: Which of the curves depicts economies of

Q16: Why will a government-imposed quantity restriction in

Q22: Jim and Lisa own a dog-grooming business

Q40: Consumers will lose no consumer surplus due

Q42: If a firm's average total costs decrease

Q55: Two policy options for reducing emissions are

Q57: If the firm expanded its scale of

Q88: External benefits arise from the actions of:<br>A)

Q126: If a good is subject to a

Q130: If a firm hires another worker and