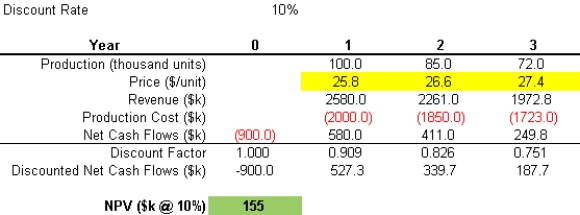

A firm is considering investing $0.9M in a typical industrial manufacturing application with a three-year production planning cycle under a forecasted market price environment. A simple three-period project pro forma cash flow sheet for this project is shown below:  In the pro forma, the production and price forecast in each period translate to revenue, which can then be netted of production costs to arrive at the expected cash flow in each period. The cash flows are then discounted at a rate that is commensurate with the riskiness of the project (here, assumed to be 10%).

In the pro forma, the production and price forecast in each period translate to revenue, which can then be netted of production costs to arrive at the expected cash flow in each period. The cash flows are then discounted at a rate that is commensurate with the riskiness of the project (here, assumed to be 10%).

-The Net Present Value (NPV) is the sum of the discounted cash flows. What is the NPV of the project, including the required investment?

Definitions:

Q7: Normalization works through a series of stages

Q21: A trend component of a time series

Q27: In aggregate planning models,the number of workers

Q41: Specialization is the top-down process of identifying

Q44: Suppose that one equation has 3 explanatory

Q50: is data about data through which the

Q68: The row's range of permissible values is

Q69: relates to the activities that make the

Q70: An electronic company is considering opening warehouses

Q74: Referential integrity and participation are both bidirectional,meaning