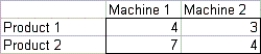

Adam Enterprises manufactures two products. Each product can be produced on either of two machines. The time (in hours) required to make each product on each machine is shown below:  Each month, 500 hours of time are available on each machine, and also customers are willing to buy up to the quantities of each product at the prices shown below:

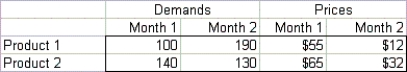

Each month, 500 hours of time are available on each machine, and also customers are willing to buy up to the quantities of each product at the prices shown below:  The company's goal is to maximize the revenue obtained from selling units during the next two months.

The company's goal is to maximize the revenue obtained from selling units during the next two months.

-(A) Determine how the company can meet its goal. Assume that Adam will not produce any units in either month that it cannot sell in that month.

(B) Referring to (A), suppose Adam wants to see what will happen if customer demands for each product in each month simultaneously change by a factor 1 + k. Revise the model so that you can use the SolverTable add-in to investigate the effect of this change on total revenue as k varies from -0.3 to 0.3 in increments of 0.1. Does revenue change in a linear manner over this range? Can you explain intuitively why it changes in the way it does?

Definitions:

Disbursement Basis

An accounting method where expenses are recorded when cash is paid out rather than when the expense is incurred.

Consolidation

The merging of assets, liabilities, and other financial items of two or more entities to form a single, combined financial statement.

Investment

Allocation of resources, usually money, in assets or projects expected to generate income or profit in the future.

Expenditure

The action of spending funds or expenses incurred by an entity in the course of its operations.

Q17: If a sample has 20 observations and

Q49: When the samples we want to compare

Q51: Which of the following statements are true?<br>A)A

Q52: Which of the following statements are false

Q55: The t-distribution for developing a confidence interval

Q60: A regression analysis between sales (in $1000)and

Q61: A car dealer in Big Rapids,Michigan is

Q72: The multiple standard error of estimate will

Q76: What is the appropriate distribution for the

Q89: Regression analysis can be applied equally well