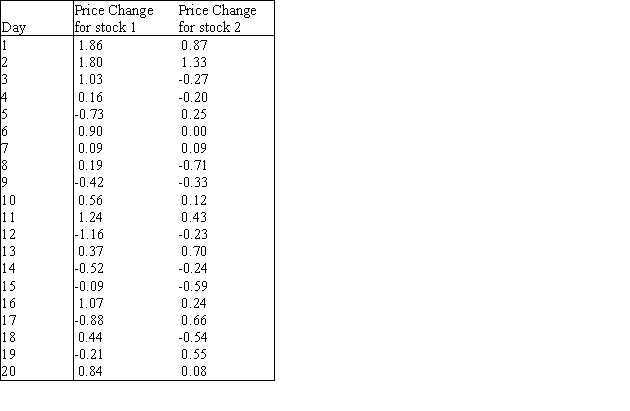

An investor wants to compare the risks associated with two different stocks.One way to measure the risk of a given stock is to measure the variation in the stock's daily price changes.The investor obtains a random sample of 20 daily price changes for stock 1 and 20 daily price changes for stock 2.These data are shown in the table below.Show how this investor can compare the risks associated with the two stocks by testing the null hypothesis that the variances of the stocks are equal.Use  = 0.10 and interpret the results of the statistical test.

= 0.10 and interpret the results of the statistical test.

Definitions:

Sociological

Related to the study of the development, structure, and functioning of human society and social problems.

Research Methodologies

The strategies, techniques, and procedures used by researchers to gather and analyze data in studies.

Anecdotal Feedback

Personal stories or observations used as a form of qualitative data or evidence, though not systematically collected.

Self-Reporting Questionnaires

A method of data collection where individuals provide information about themselves, typically regarding behaviors, attitudes, or symptoms.

Q12: In choosing the "best-fitting" line through a

Q13: The optimal solution to any linear programming

Q22: A null hypothesis is a statement about

Q36: In a multiple regression analysis with three

Q46: If all monetary values in a decision

Q60: Probabilities that cannot be estimated from long-run

Q62: In contrast to linear trend,exponential trend is

Q63: What is the probability that he will

Q63: In regression analysis,the total variation in the

Q74: The randomized response technique is a way