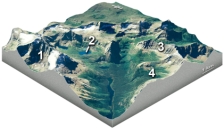

Which feature on this diagram is an arête?

Definitions:

Employer's Payroll Taxes

Employer's Payroll Taxes are taxes that employers are required to pay on behalf of their employees, which can include Social Security, Medicare, and unemployment taxes.

Federal Unemployment Taxes

Taxes paid by employers to fund the federal government's oversight of the state unemployment insurance programs.

Payroll Tax Expense

Represents the taxes that employers are required to pay based on the wages and salaries of their employees; this includes taxes like Social Security and Medicare in the US.

State Unemployment Taxes

Taxes paid by employers to fund the state's unemployment insurance program, providing financial assistance to workers who have lost their jobs.

Q5: How does the seismic tomography method work?<br>A)large

Q9: Which of the following time periods were

Q38: The USGS evaluated the age of different

Q40: For these ocean currents in the South

Q44: What caused the site of the Catskill

Q45: Which of the following settings contains the

Q46: In the landscape pictured here,choose the location

Q53: Which of the following can influence a

Q65: On the image below,what feature will be

Q83: This figure shows the main subdivisions of