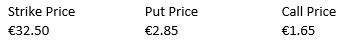

Consider the following information on put and call options for Abel Group  Calculate the net value of a protective put position at a stock price at expiration of €20, and a stock price at expiration of €45.

Calculate the net value of a protective put position at a stock price at expiration of €20, and a stock price at expiration of €45.

Definitions:

Four Ps

The marketing mix concept that consists of Product, Price, Place, and Promotion, used to guide business marketing strategies.

Marketing

The activities and processes for creating, communicating, delivering, and exchanging offerings that have value for customers and society at large.

Monetary Price

The specific amount of money required to purchase a product or service.

Supply Chain Manager

A professional responsible for overseeing and managing a company's overall supply chain and logistics strategy to maximize efficiency and productivity.

Q1: For the three sampling techniques that aren't

Q3: The gamma of a cash-or-nothing binary call

Q3: Futures differ from forward contracts because<br>A) futures

Q8: "Basis" risk may arise in a hedging

Q11: The institutions which invest most heavily in

Q12: You plan to borrow $1,000,000 for six

Q13: I hold a long position in a

Q19: Why should the auditor examine performance indicators?

Q21: Describe examples of people risks relevant to

Q34: You are interested in hedging a portfolio