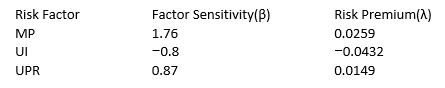

The table below provides factor risk sensitivities and factor risk premia for a three factor model for a particular asset where factor 1 is MP the growth rate in US industrial production, factor 2 is UI the difference between actual and expected inflation, and factor 3 is UPR the unanticipated change in bond credit spread.  Calculate the expected excess return for the asset.

Calculate the expected excess return for the asset.

Definitions:

On-line Banking

The provision of banking services over the internet, allowing users to conduct financial transactions remotely.

Transaction Speed

The rate at which a financial transaction is processed from initiation to completion.

Convenience

The quality or state of being convenient, especially in terms of ease of access or use, often used in marketing to describe consumer products or services.

Cash Handling Procedures

Guidelines and methods a company follows to manage and safeguard the cash it receives and disburses.

Q3: What accounting and audit issues may arise

Q5: What are the auditor's basic steps for

Q7: What is the purpose of business measurement

Q8: "Basis" risk may arise in a hedging

Q8: Refer to the previous question. What is

Q10: In the Black-Scholes option pricing model, an

Q10: In the case of open-end investment companies,

Q14: You are the auditor for a large

Q15: In order to diversify risk an investor

Q22: The tailed minimum-variance hedge ratio becomes lower