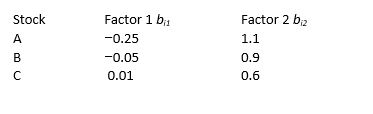

Refer to the following information. Stocks A, B, and C have two risk factors with the following beta coefficients. The zero-beta return (λ0) = 0.025 and the risk premiums for the two factors are (λ1) = 0.12 and (λ0) = 0.10.

Stock Factor 1 bi1 Factor 2 bi2 Calculate the expected returns for stocks A, B, C.

Calculate the expected returns for stocks A, B, C.

A B C

Definitions:

Recess

A period of time when proceedings or activities are temporarily suspended, often used in educational settings for breaks.

Misbehaved

Exhibiting behavior that is not acceptable based on societal or situational norms.

Cognitive-Behavioral Therapy

A therapeutic approach that addresses dysfunctional emotions, behaviors, and cognitions through goal-oriented, systematic procedures.

Aggressive Impulses

Refers to strong feelings or urges to act out in aggression or hostility.

Q1: Describe the appropriate use of the audit

Q1: The premium of an option is<br>A) The

Q2: Behavioural finance differs from the standard model

Q7: What are two ways to implement sampling?

Q8: What accounting and audit issues may arise

Q13: Define and describe enterprise risk management.<br>

Q15: Davenport Corporation's last dividend was £2.70 and

Q18: The stock price is $34. The strike

Q18: How should questions be prepared and asked

Q22: You have a portfolio with long positions