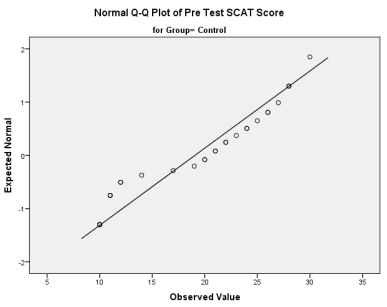

Examine the following Q-Q plot from the pre-test control group. What can be assumed from the graph?

Definitions:

Time Horizon

The length of time over which an investment or a project is intended or expected to occur.

Price Elasticity

A quantification of the demand elasticity for a good relative to its price alterations.

Price Elasticity

An indicator of the sensitivity of the demand for a product to fluctuations in its price, represented by the percentage change.

Quantity Demanded

The specific amount of a product that buyers are willing to purchase at a given price, holding all other factors constant.

Q5: The t-test can be characterized as a

Q6: Which of the following is not an

Q7: If you wanted to find out if

Q8: Based on the answers provided in Q7,

Q10: Collinearity diagnostics can be used for what

Q10: Why is the sample size so important

Q13: What does the following graph illustrate? (PD

Q17: If you were to graphically present the

Q20: Which of the following is not a

Q25: Split the data according to the sport.