NARRBEGIN: Exhibit 5-21

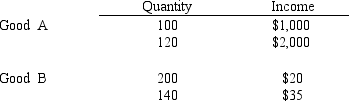

Exhibit 5-21

-Use the information in Exhibit 5-21 to calculate the value of income elasticity of demand for Good A.

Definitions:

Saving Rate

The proportion of disposable income that is saved rather than spent by households.

Tax Base

The total amount of assets or income that can be taxed by a governing authority, forming the essential revenue source.

Progressive Income Tax

A tax system where the tax rate increases as the taxable amount increases, placing a higher tax burden on high-income earners.

Ability-to-Pay Principle

A tax principle suggesting that taxes should be levied according to an individual or entity's capacity to pay, generally implying that those with higher incomes should pay more tax.

Q38: Use the information in Exhibit 5-1 to

Q39: Refer to Exhibit 4-10. A shift from

Q50: Which of the following is true of

Q52: Refer to exhibit 6-17. If D, D'

Q96: Demand for clothing tends to be<br>A) elastic

Q120: In terms of the numbers of firms

Q121: Fixed costs are defined as<br>A) the total

Q125: The cross-price elasticity of demand between rifles

Q176: The equilibrium point represents the only price-quantity

Q195: Determining the most socially desirable level of