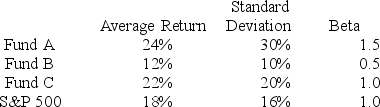

You want to evaluate three mutual funds using the Sharpe measure for performance evaluation. The risk-free return during the sample period is 6%. The average returns, standard deviations, and betas for the three funds are given below, as are the data for the S&P 500 Index.

The fund with the highest Sharpe measure is

Definitions:

Straight-Line Depreciation

A manner for spreading out the cost of a tangible asset across its useful life in regular yearly installments.

Income Taxes

Income taxes are taxes imposed by governments on the income generated by businesses and individuals within their jurisdiction.

Operating Cash Inflow

Money generated from a company's regular business operations, indicating its capacity to maintain and grow operations.

Internal Rate of Return

A metric used in financial analysis to estimate the profitability of potential investments, calculated as the rate of return that sets the net present value of all cash flows from the investment equal to zero.

Q11: What institutional mechanism results from adopting institutional

Q15: Market-neutral hedge funds may experience considerable volatility.

Q17: You purchase an interest rate futures contract

Q35: The financial statements of Burnaby Mountain Trading

Q38: The initial maturities of most exchange-traded options

Q42: A stock is trading at $50. You

Q51: Sharon decides to put $6,500 into her

Q58: A stock with a stock and exercise

Q76: Sanders, Inc., paid a $4 dividend per

Q90: Westsyde Tool Company is expected to pay