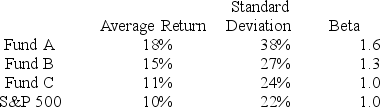

You want to evaluate three mutual funds using the Sharpe measure for performance evaluation. The risk-free return during the sample period is 4%. The average returns, standard deviations, and betas for the three funds are given below, as are the data for the S&P 500 Index.

The fund with the highest Sharpe measure is

Definitions:

Malthusian Theory

A principle suggesting that population growth will outpace agricultural production, leading to widespread poverty and famine.

Law of Diminishing Returns

An economic principle stating that adding more of one factor of production, while holding others constant, will at some point yield lower per-unit returns.

Age of Mass Consumption

A stage of economic development where a significant portion of the population engages in the widespread consumption of goods and services, often seen as indicative of a higher standard of living.

Permanent Underclass

A group within society that holds the absolute lowest rank in the social class structure, situated beneath the main portion of the working class.

Q5: Which type of political governance is increasingly

Q9: What is a common criticism of corporate

Q12: What are the three motives for transferring

Q13: What is a relatively inexpensive ways for

Q28: Use the following cash flow data of

Q40: A nonprofit organization offers a 5% salary

Q59: You are convinced that a stock's price

Q63: Unlike market-neutral hedge funds, which have betas

Q79: Which one of the following will increase

Q123: Sara is considering the purchase of a