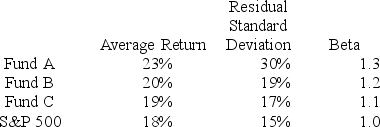

You want to evaluate three mutual funds using the Sharpe measure for performance evaluation. The risk-free return during the sample period is 5%. The average returns, standard deviations, and betas for the three funds are given below, as are the data for the S&P 500 Index.

The investment with the highest Sharpe measure is

Definitions:

Genetic Exchange

The transfer of genetic information between organisms, which can occur through processes like conjugation, transformation, or transduction in bacteria.

Gel Electrophoresis

A laboratory method used for the separation of DNA, RNA, or proteins based on their size and charge by applying an electric field to a gel matrix.

Electrical Field

A region around a charged particle where electric forces are exerted on other electrically charged particles or objects.

DNA Fragments

Pieces of DNA cut from a larger sequence by enzymes, used in various genetic analyses and manipulations.

Q4: The Black-Scholes hedge ratio for a long

Q7: What is a feature of globalization?<br>A) Increasing

Q11: The May 17, 2015, price quotation for

Q13: What is it called when international labor

Q15: What strategic IHRM orientation is demonstrated when

Q39: The market capitalization rate on the stock

Q44: The term hedge refers to an investment

Q59: You are convinced that a stock's price

Q60: Step one in the scientific method is<br>A)

Q85: The financial statements of Flathead Lake Manufacturing